The crypto world is growing, and Bitcoin and Ethereum are still the big players. If you’re a trader or investor eyeing 2025, you really need to know what makes these two tick. This includes things like their core drivers, tech plans, and how big institutions feel about them. We’re not just scratching the surface here. This article dives deep into the trends and clues that will probably tell us which one comes out on top next year.

Historical Performance & Key Market Events

Bitcoin and Ethereum have both delivered impressive growth. But their journeys have been shaped by different catalysts.

Bitcoin | Scarcity and Institutional Embrace

Bitcoin has quite a story. It’s really shown how tough it is and has definitely earned its reputation as “digital gold.” Its price is super linked to its scarcity- especially those “halving” events that pop up every four years or so. When a halving happens, the reward for “mining” new Bitcoins gets cut in half. This means fewer new supply hits the market.

The most recent one in April 2024 was a big deal, and historically, these halvings tend to kick off bull runs. New spot Bitcoin ETFs are also getting the green light in the U.S., and many more big institutions are jumping in to give the whole market a fresh boost.

Ethereum | A Story of Technological Evolution

Ethereum price USD has been on an exciting journey of growth thanks to some big network upgrades aimed at making it faster, safer, and more user-friendly. Here are the highlights:

- The Merge (2022): Ethereum moved from the energy-hungry Proof-of-Work system to the much greener and efficient Proof-of-Stake. Huge step forward!

- Shanghai Upgrade (2023): This made it possible to withdraw staked ETH and add more liquidity to boost confidence in staking.

- Dencun Upgrade (March 2024): Introduced “Proto-Danksharding.” This slashed transaction fees

on Layer 2 solutions and made Ethereum more affordable and accessible for everyone.

These upgrades have helped Ethereum stay on top as the go-to platform for smart contracts and dApps to support a thriving decentralized ecosystem.

Current Market Position and 2025 Trends

In 2025, both Bitcoin and Ethereum are finding their way through a tricky market. On one hand, big institutions are getting more involved. On the other hand, the overall economy is a bit shaky.

Bitcoin is hovering around the $114,500 mark, and Ethereum is holding steady at about $4,300, when looking at the latest numbers from late 2025. Both have had their ups and downs. Ethereum seems to be having a better year since it’s up 37% since the start of the year, while Bitcoin is up 24%.

So what’s been driving this? A huge factor was the approval of spot Ethereum ETFs back in July 2024. Just like what happened with Bitcoin ETFs, this move opened the floodgates for big money from institutions. Major asset managers like BlackRock, Fidelity, and VanEck now offer regulated ways to invest in ETH, which has caught the eye of large investors like pension funds.

This is backed up by on-chain data that shows that in just one week, over 420,000 ETH was moved out of exchanges as a strong sign that people are holding on for the long term rather than planning to sell.

Technological Roadmaps: Bitcoin vs. Ethereum

Future performance will largely depend on each network’s ability to innovate and scale.

Bitcoin: Stability and Incremental Improvements

Bitcoin’s main goal is to be super secure and stable. But let’s be real. To make it better for everyday, smaller, faster payments are really important. Ultimately, the big reason people invest in Bitcoin is its incredible scarcity and how well it holds its value. That makes it a really attractive way for big investors to protect themselves against inflation.

Ethereum: The Pectra Upgrade and Layer 2 Ecosystem

Ethereum is taking on a more ambitious and complicated roadmap. The Pectra upgrade that is set to launch around May 2025 is a huge deal. It’s designed to improve scalability, ease network congestion, and speed up Layer 2 rollups. In short, it will make it easier for developers to create advanced dApps.

Boosting scalability is a top priority since Ethereum is home to a massive ecosystem of Decentralized Finance (DeFi) and Non-Fungible Tokens (NFTs). As of July 2025, the total value locked in Ethereum’s DeFi protocols is a staggering $72.64 billion. To handle all this user activity and keep transaction fees from getting out of hand, its Layer 2 network, which includes platforms like Arbitrum, Optimism, and Base, is absolutely essential.

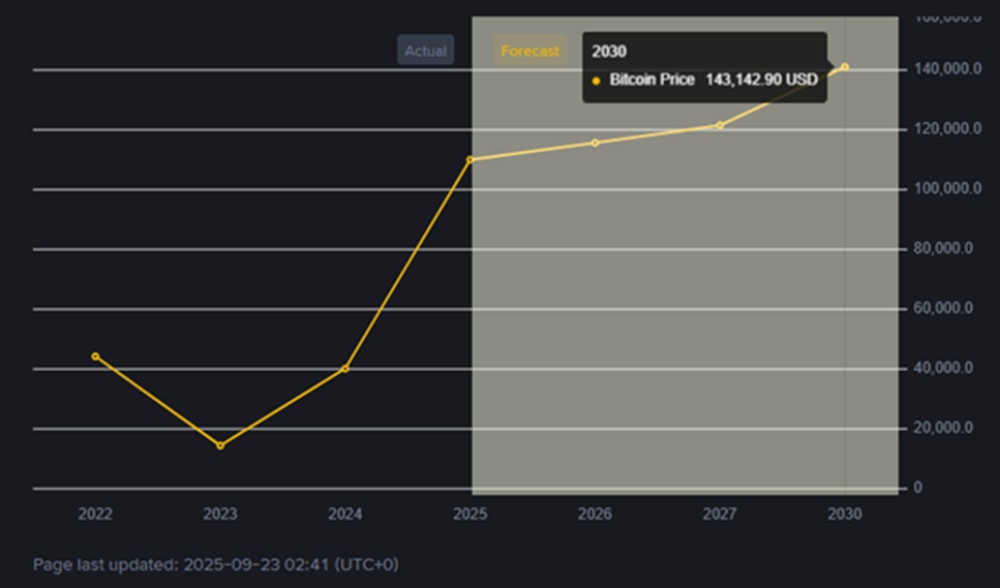

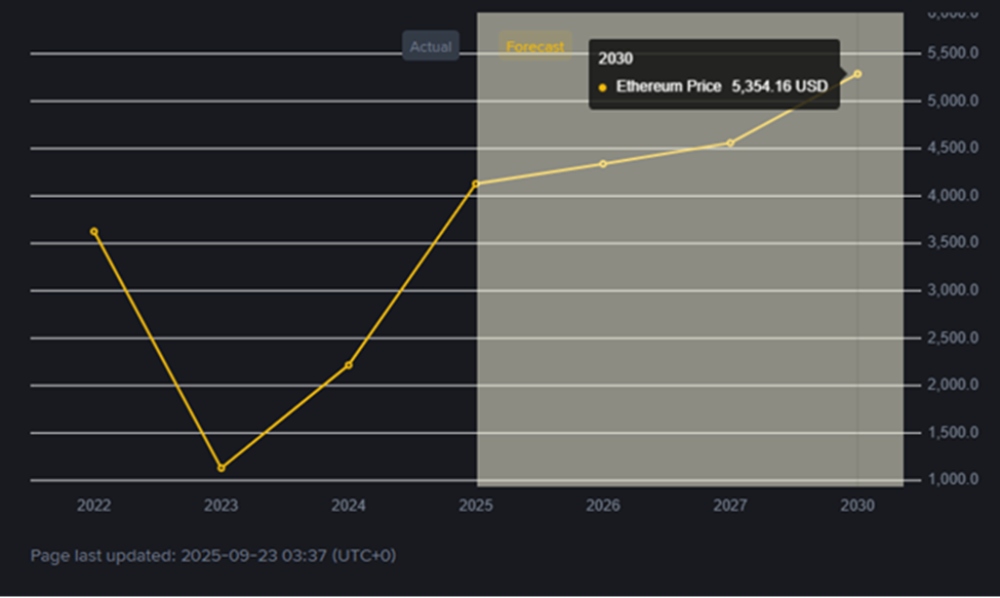

Source: Ethereum (ETH) Price Prediction & Forecast 2025, 2026, 2027, 2028-2030 | Binance

Market Sentiment and Future Outlook

Investor sentiment is shaped by both tech potential and the bigger economic picture. Many see Bitcoin as a safe bet when the economy is shaky. Meanwhile, Ethereum’s popularity is fueled by fresh innovations and its expanding digital marketplace.

Regulations are also a big piece of the puzzle. The green light for ETFs for both Bitcoin and Ethereum after the U.S. election has helped create a positive vibe.

Price Predictions for 2025

| Cryptocurrency | 2025 Price Forecast (Conservative) | 2025 Price Forecast (Optimistic) | Key Drivers |

| Bitcoin (BTC) | $115,000 | $126,000+ | Institutional ETF inflows, post-halving supply shock, status as a macro hedge. |

| Ethereum (ETH) | $5,000 | $10,000 | Pectra upgrade, ETF demand, DeFi/NFT ecosystem growth, tokenization of real-world assets. |

Experts are super optimistic about Ethereum’s price in USD. Finder’s panel thinks ETH could jump past $6,100 by 2025, and some folks at places like Standard Chartered even see it hitting $7,500 or more.

But the big catch for Ethereum is whether they can pull off all their tricky, multi-layered upgrades. Bitcoin, on the other hand, plays it safe. This means it’s pretty stable but probably won’t see the same kind of massive growth.

The Final Verdict: Who Will Lead?

So, what’s cooking for Bitcoin and Ethereum for the rest of 2025? Both are looking at some pretty big growth, but they’re heading down different paths.

- Bitcoin will probably keep doing its thing as the market’s main anchor- a solid, institutionally-backed way to store value. We’ll likely see it lead with more price stability and act as a hedge against bigger economic shifts.

- Ethereum seems set to really shine in terms of innovation and percentage growth. Its whole ecosystem is about to get way bigger with the Pectra upgrade coming up and more institutions jumping in with ETFs. If they can pull off their roadmap, the demand for ETH as the “fuel” for a new digital economy could push its value to crazy new highs. Possibly even beating Bitcoin’s gains.

The big thing to watch will be how that Ethereum Pectra upgrade goes and whether institutions keep pouring money into both cryptos for anyone trading. Bitcoin offers a steadier, scarcity-driven journey, but Ethereum? That’s where you find the higher-risk, higher-reward action, all driven by cool new tech. Ultimately, the one that really takes the lead in 2025 will be the one that best delivers on what it promises.

Akmal Fahim

(ageance)

Disclaimer : All views and opinions expressed in this article is solely that of the author and does not reflect the views of ‘Sri Lanka Mirror’. The freelance author is exclusively responsible for the content, accuracy, and legal compliance of this article. ‘Sri Lanka Mirror disclaims all liability for any errors or omissions.