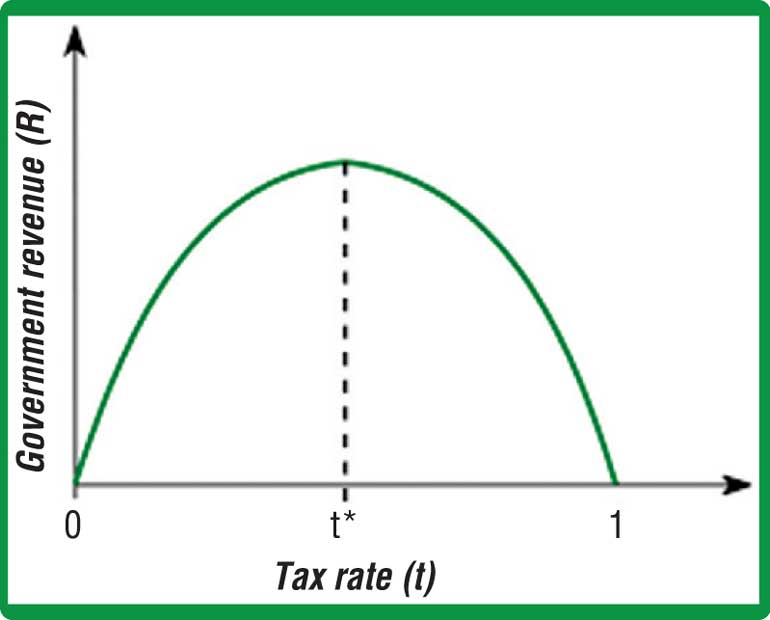

Economist Arthur Laffer in 1974 argued that cutting tax rates can result in increased total tax revenue. The Laffer tax curve is often used to illustrate the argument that cutting tax rates can result in increased total tax revenue. Today with an ongoing IMF program, the role of taxation cannot be overstated.

For most countries, taxation serves as the primary source of revenue for funding essential public services and infrastructure development. However, the imposition of high income and direct taxes in third-world economies, often under pressure from multilateral agencies invariably causes havoc that overshadows its intended economic benefits to a country. This article argues that getting the right mix of indirect taxes and direct taxes can prove potent in driving domestic economic growth, capital formation, and attracting foreign investment and domestic investment.

Excessive taxation

The Government spokesman has said increased tax revenue was essential for improving the country’s financial situation and addressing the debt crisis. Unfortunately excessive direct and indirect taxes can in many instances place a heavy burden on both individuals and businesses. While these taxes are meant to support governments to deliver on its mandate, it can have unintended consequences. Often excessive tax reduces the disposable income for individuals, reducing their ability to spend and invest. For businesses, high taxes can hamper growth, reducing capital for expansions that then create jobs.

Numerous examples exist where third-world economies have been forced to raise taxes to demonstrate fiscal responsibility to multilateral agencies. However, this approach often leads to a vicious cycle. Increasing taxes can stifle economic growth, resulting in less revenue collection than expected, ultimately undermining the very goal it aims to achieve – economic growth and poverty reduction.

Capital formation and DDI/FDI

High taxes leave little room for individuals and businesses to save and invest, which is crucial for capital formation. Accumulated capital is the driving force for economic development, enabling countries to invest in infrastructure, education, and innovation. Excessive taxation undermines this process by leaving citizens and businesses with insufficient resources for long-term investments.

Attracting foreign investment is critical for third-world nations looking to bump up growth post-COVID. Excessive taxes deter foreign investors, as they seek stable, predictable tax environments. When tax rates are excessive, most investors opt to allocate their resources to more manageable tax regime thus depriving a country from valuable foreign investment that can inject much-needed capital and technology into a country, facilitating economic growth and job creation.

Sri Lanka needs to objectively study the impact of high taxes. Therefore increasing taxes further on the public will only hurt the final economic recovery. While fiscal responsibility is crucial, it must be balanced with the need to promote economic growth and not hit the poor hard. We need to look at tax reduction strategies, simplification of tax systems, and increased efforts to combat tax evasion (many people don’t pay any taxes, just a few hundred thousand people pay taxes) and increase the pool of taxpayers. For example, start with a mandatory tax file to own a car or a house or to claim to a subsidy. Customs must up their game by improving governance and drive digitalisation. The Government by promoting a favourable tax environment, can prevent economic stagnation, encourage savings and attract new foreign investment.

We need to improve revenue collection rather than continue to increase tax rates and squeezing the existing taxpayers dry. Otherwise the typical middle-class family that is struggling due to the taxes reducing their overall buying power, will continue to negatively affect businesses and retailers across the country. Given that Sri Lanka has the lowest government revenue among South Asian countries, amounting to only 9.1% of its GDP the much needed Policy consistency in Sri Lanka’s tax regime and structure, including customs duties, excise taxes, Direct and indirect taxes and para tariffs is now an absolute necessity.

Famous economist Arthur Laffer in his graph visually shows the relationship between tax rates and the amount of tax revenue collected by governments. The curve is often used to illustrate the argument that cutting tax rates can result in increased total tax revenue.

References:

https://www.investopedia.com/terms/l/laffercurve.asp#:~:text=The Laffer Curve is based, in increased total tax revenue.

https://www.presidentsoffice.gov.lk/index.php/2023/02/21/the-current-tax-policy-is-not-a-normal-tax-policy-but-a-rescue-operation-president/?lang=en

Source: DailyFT