LISTEN TO STORY

WATCH STORY

By: Isuru Parakrama

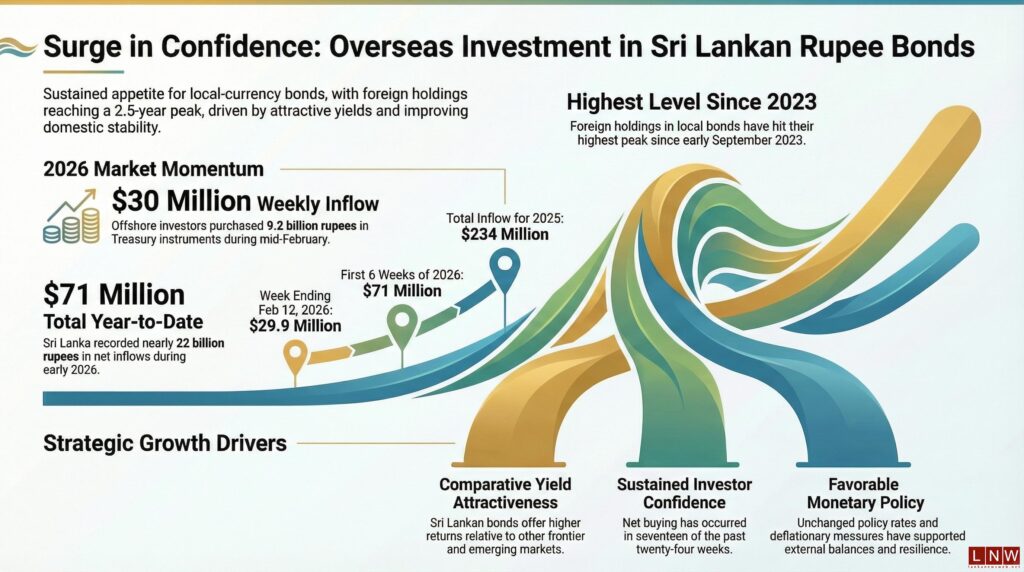

February 15, Colombo (LNW): Foreign appetite for Sri Lankan government securities has strengthened once again, with almost US$30 million flowing into local-currency bonds during the week ending February 12, figures released by the Central Bank of Sri Lanka (CBSL) disclosed.

The latest data indicate that offshore investors purchased a net 9.2 billion rupees’ worth of Treasury instruments over the week — equivalent to roughly US$29.9 million at prevailing exchange rates. This marks the seventeenth week of net foreign buying in the past twenty-four weeks, signalling sustained confidence in the island’s debt market.

Over the most recent three-week period alone, overseas investors have channelled more than 23 billion rupees (approximately US$76–77 million) into rupee-denominated government securities. As a result, total foreign holdings in local bonds have climbed to their highest level in nearly two and a half years, reaching a peak last seen in early September 2023.

Cumulatively, Sri Lanka has recorded a net foreign inflow of nearly 22 billion rupees — about US$71 million — during the first six weeks of 2026. Market participants suggest that this steady influx reflects improving macroeconomic indicators and relative yield attractiveness compared with other frontier and emerging markets.

Globally, investors remain watchful of signals from the Federal Reserve regarding potential interest rate reductions. Historically, expectations of rate cuts in the United States have encouraged capital to seek higher returns in emerging economies. Analysts note that such shifts can redirect funds towards markets like Sri Lanka, particularly when domestic reforms and fiscal consolidation are perceived to be on track.

Sri Lanka experienced total foreign inflows of around 71.5 billion rupees (approximately US$234 million) into rupee bonds during 2025. However, sentiment has not been immune to global volatility. In the wake of tariff announcements by former US President Donald Trump last April, the country saw an outflow of just over 10 billion rupees within a fortnight, accompanied by renewed pressure on the rupee.

Despite episodes of currency depreciation, foreign investors have continued to accumulate local bonds. Analysts attribute this resilience to tight monetary conditions and deflationary policies that have curtailed imports and supported external balances. The Central Bank has maintained its key policy rates unchanged since May last year, following an aggressive easing cycle that delivered cumulative cuts of 825 basis points over two years.

With yields remaining comparatively attractive and external financing conditions gradually stabilising, market observers believe Sri Lanka could continue to draw selective foreign inflows — provided global risk sentiment does not deteriorate sharply.

The post Overseas Investors Channel Nearly US$30 Million into Sri Lankan Rupee Bonds appeared first on LNW Lanka News Web.