Why We should not Privatize Litro Gas Lanka Ltd & Litro Gas Terminal Lanka (Pvt) Ltd.

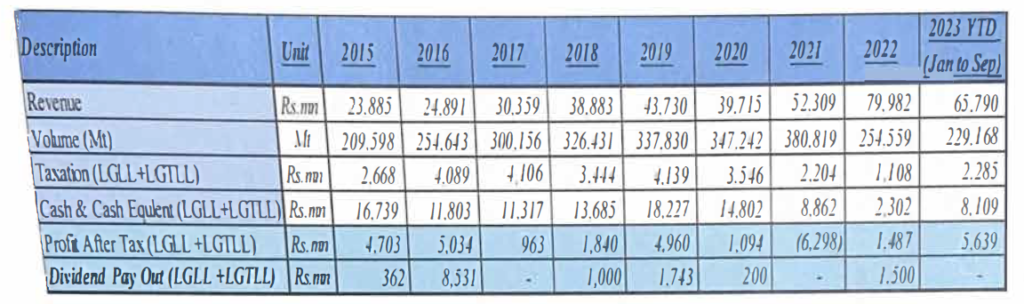

- Economic Contribution: In July 2022, the company received a long-term loan of USO 70 million from the World Bank to aid the government during a foreign exchange crisis. This loan, equivalent to Rs. 25.8 billion, was expeditiously repaid by December 30, 2022, in order to address the government’s pressing financial needs.

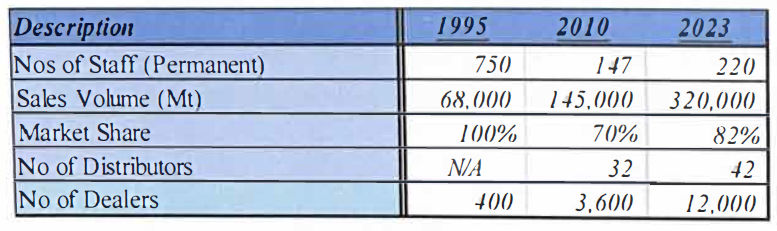

- Resilience: Litro Gas Lanka Ltd swiftly recovered its business in a short period following an economic crisis, demonstrating its ability to adapt and thrive.

- Revenue and Profitability: The company’s current average annual revenue stands at Rs. 75 billion, with an average annual profitability of Rs. 4-5 billion.

- Dividends and Taxes: Since 2015, the company has paid a total of Rs. 13.4 billion in dividends and Rs. 27.6 billion in taxes.

- Debt Management: Litro Gas Lanka Ltd obtained short term loan facility around Rs. 10 billion from commercial banks in 2022 and efficiently cleared all outstanding amounts. Presently, the company holds no outstanding loans and has no financial obligations to the national treasury or any commercial bank.

- Financial Health: Litro maintains a current cash equivalent of Rs. 8.1 billion. ensuring its financial stability.

- Labor Relations: The absence of trade unions within the company is a positive factor in maintaining operational efficiency.

- Establishing a joint venture (JV) with a qualified credible management team that can safeguard employees’ rights and ensure the smooth and effective operation of the company

- Infusion of advanced technology and systems by the JV can optimize operational efficiency

- The JV can explore opportunities to introduce the Litro brand to new markets outside Sri Lanka and develop new products like LNG and CNG